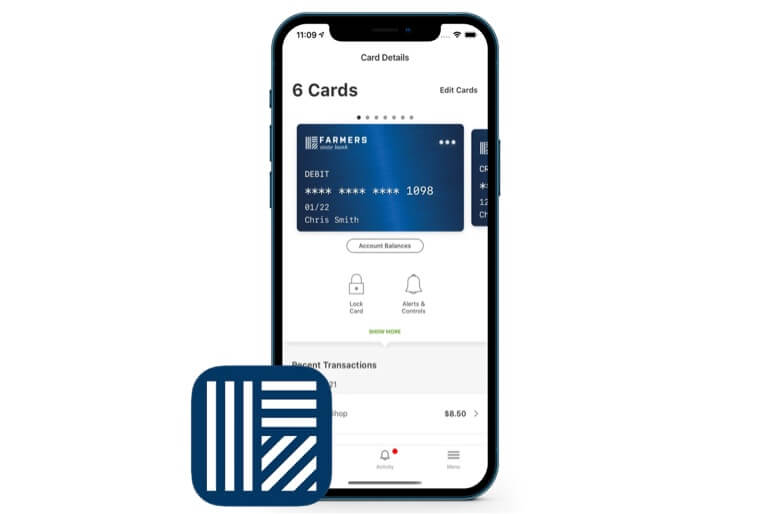

Card Management & Tracking Services

Manage your finances while guarding against fraud by using our card management and tracking services.

• Pay with Apple Pay®, Google Pay™, or Samsung Pay®

• Access enriched transactions to clearly see where your purchases are made

• Access recurring payments for subscriptions and cards on file with merchants, allowing you to keep tabs on where your card is stored

• Access simplified reporting of lost or stolen cards, including the ability to turn your card off when you are not using it to help safeguard against fraud and turn it back on when you are ready to use it again

• Establish transaction controls for dollar amount limits, merchant categories, and geographic locations

• Receive real-time alerts and set controls on where, when, and how your card is used based on the transaction controls set by you

• Receive real-time fraud text notification alerts on attempted and declined transactions

• Get real-time balances for your accounts

• Track spending by month, category, and more

Scroll to learn more about our Premium Text Notifications and Mobile Wallet services.

Contact Us

For any questions regarding card management or tracking services, please call 785.457.3316 or email us at support@bankwithfarmers.com.

Premium Text Notifications

Our text alert service allows you to instantly keep tabs on suspicious card activity. At Farmers State Bank, we want to make sure that using your debit card is always as safe and convenient as possible. That’s why we use text alerts as part of our ongoing fraud monitoring program.

Watch the video to learn how the text fraud alerts process works

With Farmers State Bank’s fraud monitoring, keeping your card safe is as easy as sending a text.

How It Works

With text fraud alerts, if our system detects suspicious activity on your card, you’ll receive a text message with details about the suspected transaction. All you have to do is respond to the text to confirm the transaction.

If you indicate the transaction is fraud, you’ll receive another message with a number to call for follow-up. If not, you’re all set. The system will mark the transaction as legitimate and you can get on with your day – simple as that.

Getting Started

If we have your mobile phone number on file, you don’t have to do anything. It’s really that easy. If there is suspicious activity, we’ll send a text alert right away.

If you need to verify or update your mobile phone number, give us a call at 785.457.3316.

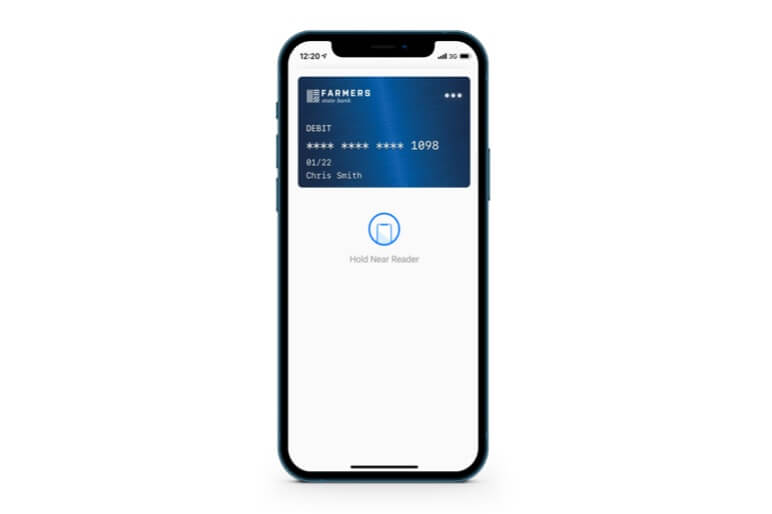

Mobile Wallet

Purchasing has never been easier. You can use Apple Pay®, Google Pay™, or Samsung Pay® with your debit card to pay quickly, conveniently, and securely at checkout in stores, online, and for in-app purchases. Your card number is never exposed to merchants, keeping your transactions safe at all times.